Kakuzi Plc (KUKZ) has evolved from a traditional farm into a vertically integrated superfood exporter, capturing the attention of the entire market. As of February 12, 2026, the stock is trading at KES 411.00, demonstrating a steady climb toward its 52-week high of KES 440.00. This momentum is not accidental; it is driven by a massive shift in retail investor interest toward the agribusiness sector.

Table of Contents

Search interest for “Kakuzi share price today” has surged by over 900% in the last quarter alone. This digital fever signals that the market is finally recognizing the value of a company that controls its supply chain. from the soil to the supermarket shelf. Investors are no longer just buying a stock; they are buying into a food security and export narrative.

The company has successfully repositioned itself as the “King of the NSE” agricultural sector. By moving away from raw commodity dependence and embracing value addition, Kakuzi has insulated its shareholders from typical market volatility. The 2026 fiscal year promises to be a defining moment for this agricultural giant.

What Financial Highlights Define the H1 2025/2026 Backbone?

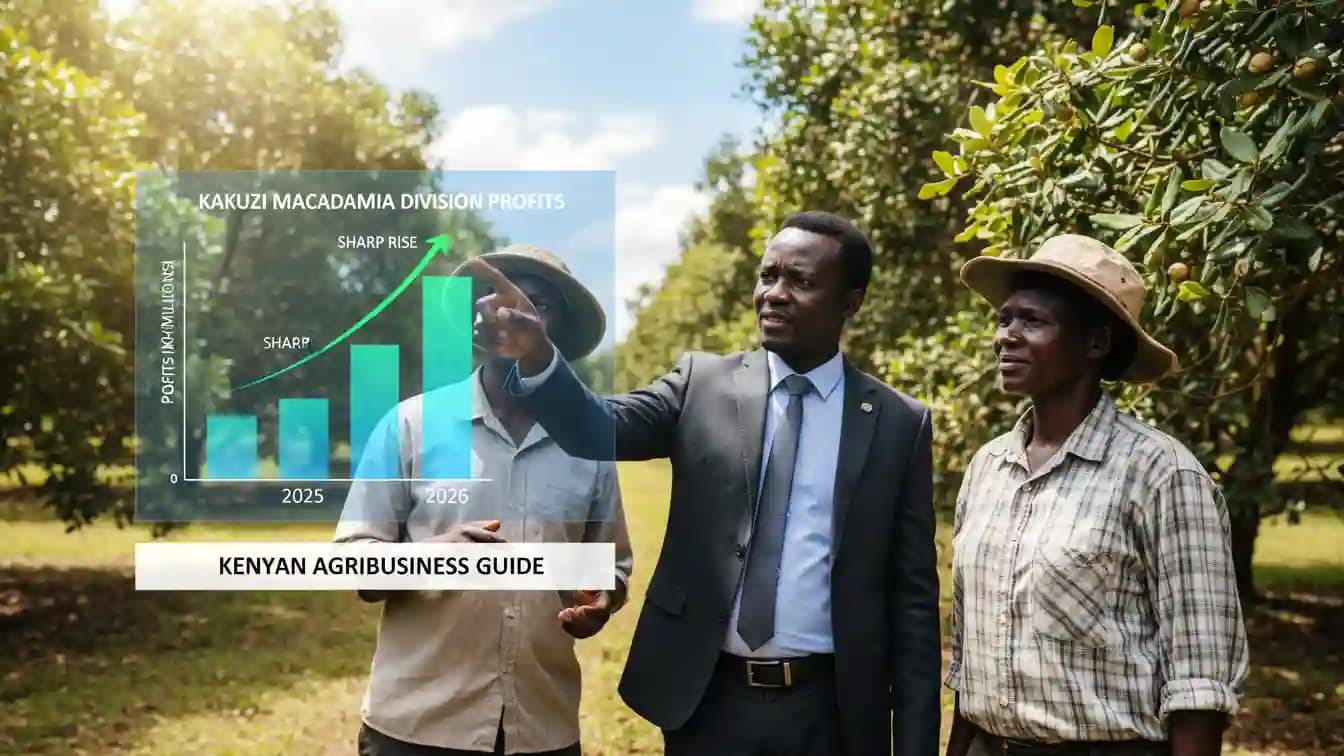

The financial backbone of Kakuzi in 2026 is defined by a revenue jump to KES 1.51 Billion in the H1 2025 results. This growth is underpinned by a massive recovery in the Macadamia division, which flipped a previous KES 32M profit into a staggering KES 319M. Additionally, the blueberry venture has officially turned profitable, contributing KES 13 Million to the bottom line.

Revenue Growth and Market Resilience

The jump to KES 1.51 Billion in revenue highlights the company’s ability to scale operations despite global economic headwinds. This figure represents more than just sales; it reflects the efficiency of their export logistics and currency hedging strategies. As the Kenya Shilling stabilizes, Kakuzi continues to maximize its earnings from hard currency exports.

The Macadamia Profit Flip

In 2025, global avocado prices faced suppression due to an oversupply in key markets like Peru and Mexico. However, Kakuzi demonstrated the power of diversification through its macadamia division. Turning a modest KES 32 Million profit into KES 319 Million acts as “Diversification Insurance” for the entire portfolio.

Blueberry Profitability Milestone

The long-awaited profitability of the blueberry division has finally arrived. Generating KES 13 Million in profit proves that the 10-year expansion plan is working effectively. This high-value crop is now a proven revenue stream that will likely grow exponentially as more bushes reach maturity.

Which “Four Pillars” Anchor the 2026 Bull Case?

The 2026 bull case rests on four pillars: Avocado Hegemony with a target of 5 million cartons, value addition via the new Macadamia Oil plant, the launch of Kakuzi Pure Black Tea, and steady income from treated fencing posts. These pillars diversify revenue streams across export and domestic markets.

Pillar 1: Avocado Hegemony

Kakuzi has set an ambitious goal to export 5 million cartons of Hass avocados annually. This volume is supported by their aggressive entry into the Chinese and Indian markets, where demand for superfoods is skyrocketing. By securing direct trade routes, they are bypassing middlemen and capturing a larger share of the final retail price.

Read Also: Top 7 Best AI Apps for Kenyan Farmers in 2026: Fight Crop Diseases, Cut Costs and Boost Yields

Pillar 2: Value-Addition (The 1,000L Plant)

The commissioning of the new Macadamia Oil plant in Makuyu is a game-changer for margins. Selling processed “Oil” instead of raw “Nuts” effectively doubles the profit margin per unit of biomass. This facility processes nuts that would otherwise be rejected for aesthetic reasons, turning waste into premium cosmetic and culinary oil.

Pillar 3: The New Tea Frontier

February 2026 marks the launch of “Kakuzi Pure Black Tea” for the local Kenyan market. This strategic move is their first major effort to reduce dependence on volatile international tea auctions. By building a domestic brand, Kakuzi ensures a steady cash flow that is immune to global shipping disruptions.

Pillar 4: Infrastructure Income

The treated fencing posts business remains a “steady eddy” for the company’s cash flow. While crop cycles are seasonal and weather-dependent, the demand for high-quality fencing materials in Kenya is constant. This division provides the operational liquidity needed to support the more volatile agricultural ventures during off-seasons.

Where to Buy KUKZ shares IN 2026

Investors can buy KUKZ shares through any licensed Nairobi Securities Exchange (NSE) stockbroker or investment bank. Digital options include mobile trading apps like the NSE App, AIB DigiTrader, or heavy-duty platforms provided by banks like Standard Investment Bank. Orders are matched electronically, and ownership is secured in a CDSC account.

Licensed Stockbrokers and Banks

To acquire shares, you must open a Central Depository and Settlement Corporation (CDSC) account. Dyer & Blair, Genghis Capital, and Kestrel Capital are among the leading brokers who can facilitate these trades. They offer research notes and corporate access that can help you time your entry into the stock.

Mobile Trading Platforms

For retail investors, mobile apps have democratized access to Kakuzi shares. Platforms allow you to transfer funds directly from M-Pesa to your trading wallet. This ease of access has contributed significantly to the increased retail volume seen in early 2026.

Direct Investment Caution

It is important to note that you cannot buy shares directly from the farm in Murang’a. All equity transactions must go through the exchange. Be wary of any third-party agents claiming to sell “allocated” shares outside of the official market structure.

What Does the Dividend Analysis Reveal for Patient Wealth?

Kakuzi is a “Patient Wealth” play, highlighted by its consistent dividend history, including the KES 24.00 per share payout in 2025. Investors should mark March 25, 2026, for the next full-year audited results and dividend announcement. The yield consistently beats traditional savings accounts when adjusted for inflation.

Historical Payout Consistency

Kakuzi has a reputation for rewarding shareholders, as evidenced by the KES 24.00 dividend paid in 2025. This payout ratio demonstrates the board’s commitment to returning cash to investors rather than hoarding it. For income-focused portfolios, this consistency provides a reliable annual “paycheck.”

Read Also: How to Get Instant Farm Input Mobile Loans in Kenya 2026: Digital Credit Apps and Bank Options

March 2026 Watch List

Smart investors have marked March 25, 2026, on their calendars. This is the anticipated date for the release of full-year audited results and the declaration of the next dividend. Historically, the share price tends to rally in the weeks leading up to this announcement as traders position themselves for the payout.

Yield vs. Inflation

When you calculate the dividend yield ($$Dividend / Share Price$$), KUKZ often outperforms standard bank deposits. In an environment where inflation erodes cash savings, holding a productive asset like Kakuzi offers a hedge. The combination of capital gains and dividend income creates a total return that is hard to match in other sectors.

How Do Risk Management and ESG Factors Build Trust?

Kakuzi mitigates risk through climate resilience strategies like drip irrigation and pot-grown blueberries, protecting crops from erratic 2026 weather. They have taken proactive legal steps regarding land claims to ensure shareholder rights are secure. The “Avocademy” partnership program boosts ESG scores by supporting smallholder farmers.

Read Also: 10 Most Profitable Farming Ventures in Kenya for 2026

Climate Resilience Strategies

The erratic weather patterns of 2026 pose a significant threat to traditional agriculture. Kakuzi has countered this by investing heavily in micro-drip irrigation systems and dams. Their shift to pot-grown blueberries allows for precise water and nutrient management, ensuring yields remain high even during dry spells.

Land Claims and Security

To build trust, the company has been transparent about historical land claims. They have engaged in proactive legal and community dialogues to ensure that shareholder rights are secure. This open approach reduces the political risk premium often associated with large land-holding companies in Africa.

The “Avocademy” Impact

The “Avocademy” is a smallholder partnership program that provides training and seedlings to local farmers. This initiative ensures a steady supply chain for the packhouse while winning crucial ESG points. International investors increasingly view this social license to operate as a key metric for long-term sustainability.

Conclusion

Kakuzi Plc (KUKZ) is not a stock for the “get-rich-quick” crowd; it is a financial fortress for the serious investor. While other sectors face 2026’s economic volatility, Kakuzi has built an export engine that turns Kenyan soil into hard currency.

By controlling the entire value chain, from the Makuyu orchards to European retail shelves, Kakuzi has effectively “de-risked” agribusiness. For the farmer-investor, this is more than a ticker symbol; it is a chance to own a piece of the most sophisticated agricultural machine in East Africa. If you are looking for a compounder that pays you to wait via consistent dividends, KUKZ isn’t just a “buy,” it’s a cornerstone asset for the next decade.

Farmers Also Ask (FAQ)

Is Kakuzi a good investment for beginners?

Yes, Kakuzi is considered a stable entry point for beginners due to its established track record and consistent dividends. It provides exposure to the agricultural sector without the direct risks of farming. However, the high share price may require a larger initial capital outlay compared to penny stocks.

How often does Kakuzi pay dividends?

The company typically pays dividends once a year. The declaration usually happens in the first quarter, following the release of full-year financial results. The payment is then processed after shareholder approval at the Annual General Meeting.

What is the minimum investment for KUKZ?

The Nairobi Securities Exchange requires a minimum purchase of 100 shares. At a price of KES 411.00, the minimum investment would be approximately KES 41,100. Brokerage fees and transaction levies will add a small amount to this total.

Can I export my avocados through Kakuzi?

Through the smallholder program, farmers can partner with the company to supply avocados. However, the fruit must meet strict quality and phytosanitary standards. Interested farmers should contact the Kakuzi horticulture department for specific requirements and contracts.

Why is the KUKZ share price so high?

The share price reflects the high book value of the company’s assets, including thousands of acres of prime land and mature orchards. Unlike many other companies, Kakuzi has not performed a share split in recent years. This keeps the nominal price high, attracting long-term institutional investors.

What risks does Kakuzi face?

The primary risks include climate change, pest infestations, and currency fluctuations. Changes in export regulations in key markets like the EU or China can also impact revenue. The company actively manages these risks through diversification and insurance.